Table of Contents

Canadian banks and credit unions are in a race to attract and retain deposits, but the real challenge isn’t in finding the funds. It’s in overcoming the operational barriers that slow down growth, limit flexibility, and add unnecessary risk.

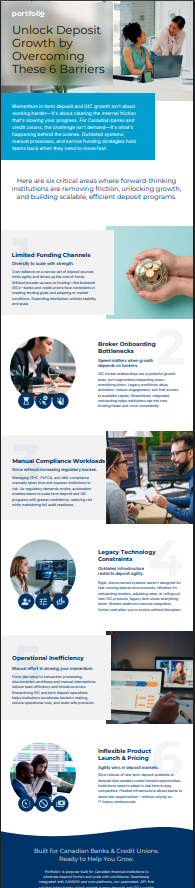

At Portfolio+, we’ve seen how even top-performing institutions lose momentum due to legacy systems, manual processes, and compliance overload. That’s why we created this actionable infographic:

“Unlock Deposit Growth by Overcoming These 6 Barriers” a quick, visual guide to the six biggest obstacles holding financial institutions back, and the proven ways to break through them.

What’s Holding Back Deposit Growth

Even as demand for term deposits and GICs continues to rise, internal friction often prevents financial institutions from scaling efficiently. Here are six hidden barriers that silently slow growth:

-

Limited funding channels that restrict access to capital and raise costs.

-

Broker onboarding delays that stall momentum and reduce engagement.

-

Legacy technology that makes it hard to launch or update deposit products.

-

Manual compliance work that increases risk and drains productivity.

-

Disconnected workflows that cause errors and inefficiencies.

-

Inflexible product rollout processes that miss market opportunities.

Each of these challenges costs valuable time, and market share. The good news? Every one of them can be fixed with the right technology.

The Competitive Edge: Automation and Agility

Today’s deposit environment rewards speed, transparency, and adaptability. That’s exactly what Portfolio+ delivers.

Our automated, API-first platform, built for Canadian banks and credit unions, removes friction across the entire deposit lifecycle, from onboarding to compliance to product management.

With Portfolio+, your institution can:

✅ Expand funding channels through streamlined broker connectivity.

✅ Automate compliance for CDIC, FATCA, and AML — and stay always audit-ready.

✅ Accelerate broker onboarding and tap new funding sources faster.

✅ Simplify rate management and term deposit workflows.

✅ Launch new deposit products faster, without heavy IT involvement.

The result?

-

Lower operational costs

-

Faster time to market

-

Greater agility and control

This is how Canada’s most forward-thinking financial institutions are scaling deposit programs with confidence.

See the Six Barriers and How to Overcome Them

If your team is ready to remove bottlenecks and unlock growth, this infographic is your roadmap.

You’ll learn how leaders in Canadian banking are modernizing their deposit operations — and how your institution can do the same with less effort and more impact.

Click the image to download the infographic and see exactly where top institutions are finding their next wave of growth.

Want to see how this could work for your institution?

Let’s talk about how Portfolio+ can help you grow deposits faster, smarter, and with less friction.

Comments are closed.