Table of Contents

Why Banks, Credit Unions, and Alt-Lenders Need to Act Now

Lending isn’t just a revenue stream, it’s the engine that powers member trust, community impact, and long-term growth. But in today’s rapidly evolving financial landscape, traditional lending processes are falling behind.

Between margin compression, growing regulatory demands, and tech-savvy borrower expectations, financial institutions in Canada are at a crossroads: continue patching legacy systems, or modernize lending from the core out.

Let’s break down how lending innovation is transforming the way financial institutions operate, and why that matters right now.

1. Automation in Lending: Fast, Frictionless, and Future‑Proof

Manual lending processes are no longer sustainable, they’re slow, error‑prone, and create bottlenecks in an experience‑driven market.

Portfolio+ Lending Software supports this transformation with configurable loan origination and servicing modules that embed seamlessly into existing core environments—no costly overhauls required.

The global shift toward automation is clear: Capgemini’s 2025 report highlights that “automation and data analytics will make it easier for banks to monitor the progress of each customer, offering advice or interventions whenever circumstances dictate”

2. Lending Analytics: Data‑Driven Decisions, Smarter Risk

Canadian regulators now expect proactive risk management, especially unilateral with OSFI’s intensified scrutiny around mortgage renewals and rising household debt. Meanwhile, TransUnion Canada projects consumer credit activity growth into 2025, with total consumer debt topping CAD 2.5 trillion in Q3 2024.

Portfolio+ analytics helps you:

-

Monitor portfolio health continuously

-

Generate audit‑ready loan‑level risk reports

-

Segment campaigns by borrower behavior, lifecycle, and product affinity

3. Digital Lending Platforms: The Baseline Expectation

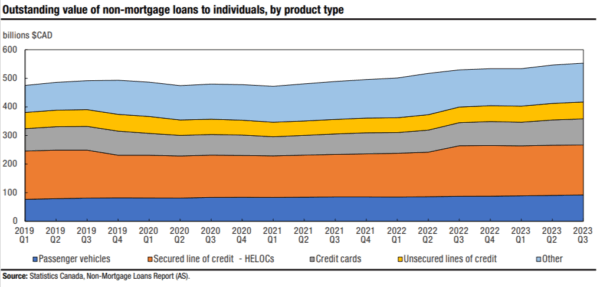

Statistics Canada’s recent study confirms mortgages represent 70% of total lender-issued loans, with non-mortgage balances trending above pre-pandemic levels PwC+5OSFI+5The Wall Street Journal+5Statistics Canada+1Statistics Canada+1. That means borrowers want fast, mobile-first loan experiences across product types.

Portfolio+ delivers out‑of‑the‑box digital lending—e-signature, real-time status updates, omnichannel support, personalized borrower journeys, built specifically for Canadian credit unions and banks.

4. Compliance, Security & Fintech Integration: The New Standard

OSFI updated its Guideline B‑10 effective May 1, 2024, enforcing a risk-based approach to third‑party risk oversight, governance, cyber resilience, and concentration risk . Aligning with B‑13 (Technology & Cyber Risk) is now non-negotiable, especially as digitization accelerates .

Portfolio+’s cloud‑based solutions include real‑time AML/KYC checks, secure document workflows, Canadian data residency, encryption, and full audit trail support—so you can innovate while staying ahead of OSFI, FINTRAC, and provincial standards.

5. Commercial Real Estate Lending: A Competitive Landscape

CBRE Canada’s “Canadian Real Estate Lenders Report 2025” indicates lenders overseeing CAD 200 billion in CRE debt are preparing for a more active 2025, with increased competition and greater debt availability.

Built-in risk analytics and benchmarking in Portfolio+ allow institutions to monitor CRE portfolio performance, stress-test scenarios, and make smarter lending decisions ahead of market shifts.

The Canadian Lending Roadmap: What Comes Next?

-

In 2025, employers expect credit growth to continue even as interest rates stabilize.

-

Expect scrutiny from OSFI around mortgage renewals, 76% of outstanding mortgages renew by end‑2026.

Portfolio+ partners with credit unions, banks, and alternative lenders to integrate automation, analytics, and digital capabilities, delivering compliant, scalable lending ecosystems built to drive growth, reduce costs, and keep pace with regulatory and borrower expectations.

Let’s Modernize Lending, Together.

Explore how Portfolio+ can transform lending from a challenge into a strategic advantage.

Learn more about our Lending Software:

https://portfolioplus.com/core-banking/lending-software-canada/

Comments are closed.