Table of Contents

What’s the Difference Between Consumer-Directed Finance and Open Banking?

First off, let’s get all the confusion out of the way. If you’re wondering what consumer-directed finance means, there’s a good chance you’re also wondering what open banking means. And that’s not your fault. The terminology around how industry players and advisors talk about the financial services framework has evolved since 2018 when the Ministry of Finance took its first steps towards introducing an open banking framework in Canada. And what initially started out as a review into open banking has progressed into discussions around data security in a consumer-directed finance framework.

So, what happened? Why did the way we talk about open banking change? And what’s the difference between open banking and consumer-directed finance?

Well, there is no difference. It’s just an informed change in terminology. That change comes as a recent recommendation from the Ministry of Finance’s Advisory Committee on Open Banking—a group that was assembled by Finance Minister Bill Morneau in late 2018 to review the merits and risks of an open banking framework in Canada. Perhaps a bit of background will help.

A Brief History of Open Banking in Canada

The Open Banking Advisory Committee prepared the review in early 2019, when they released a consultation document and invited industry stakeholders to comment. Following their initial review, the committee prepared a report advising the federal government to take steps to implement open banking in Canada. Along with that recommendation, the committee also proposed changing the term open banking to consumer-directed finance, citing that the term open banking left “the impression that [consumers’] banking information would be laid out in the open, with little consideration for personal privacy rights.”

It’s a simple change, but one that was intended to capture the fundamental notion that open banking isn’t open. And it definitely shouldn’t imply any of the same underlying characteristics of open source technology. Open banking is designed around security and personal privacy, and its focused on putting consumers in control of their data. So, while we shift towards calling it consumer-directed finance here in Canada, in other economies around the world open banking still remains the preferred term for this financial services framework. We’ll just have to deal with that for now.

With all that confusion out of the way, let’s dive deeper into how consumer-directed finance works and what it means for Canadians, businesses, and consumers.

How Does Consumer-Directed Finance or Open Banking Work?

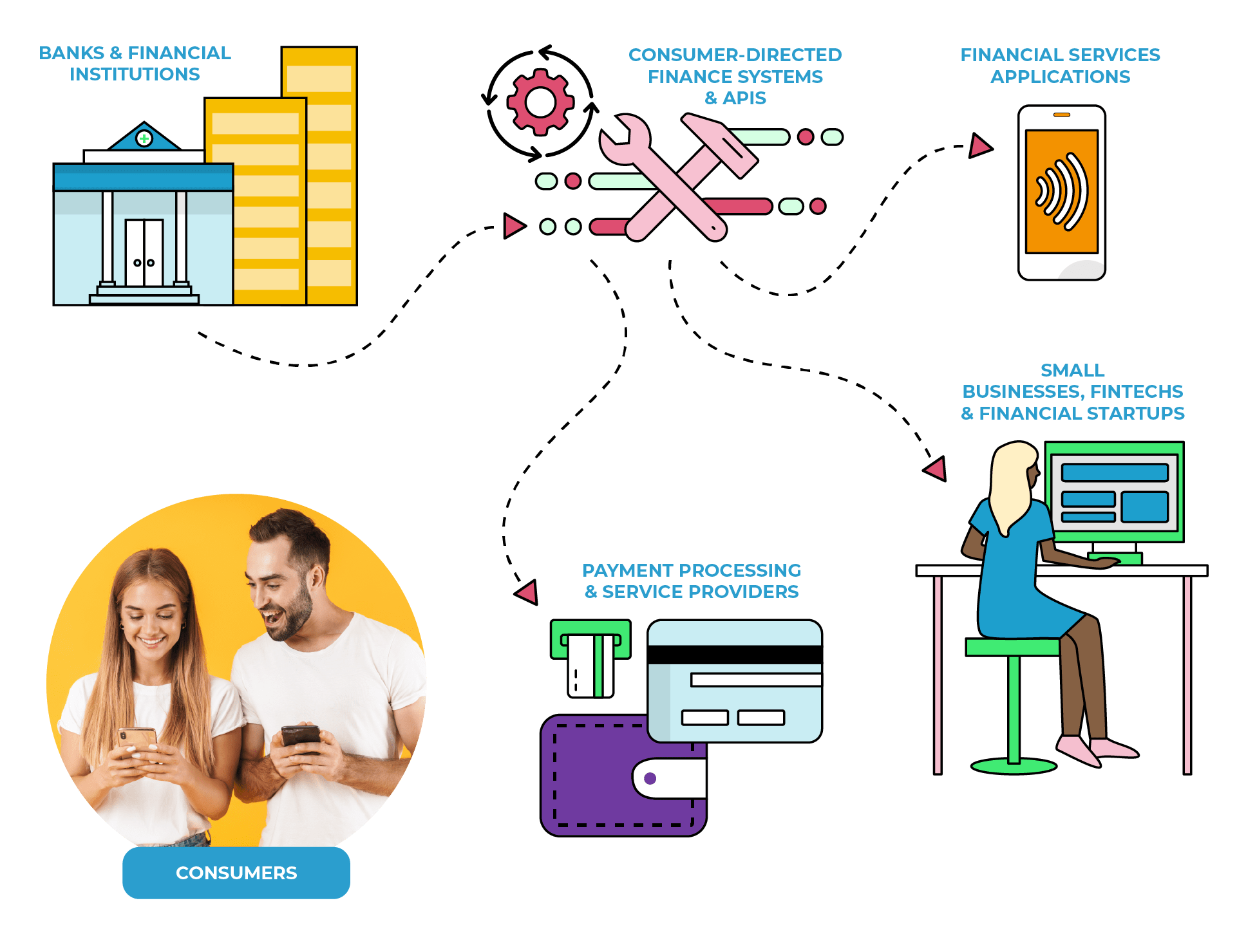

Consumer-directed finance is a framework where consumers have complete control over their financial data. Here’s how it works: Consumers grant third-party financial service providers access to their personal data at financial institutions. Once consumers authorize access to their data—either through an app or an online service—their third-party providers leverage secure online channels called application programming interfaces (APIs) to access financial data stored at financial institutions. These third-party providers can then use that data for creative and innovative new services and products focused on helping consumers better manage their personal finances.

Everyone Benefits from Consumer-Directed Finance

Who benefits from consumer-directed finance model? It really has the potential to benefit every player in the industry. The benefits to consumers are quite clear—people have more options and more opportunities. They have more choice. They can explore new kinds of banking services offered by startups that are focused on improving a specific area of banking and have uncovered creative new ways to generate revenue. Consumers can leverage their data to make more informed financial decisions by connecting with technology that uses algorithms to gather intelligence about spending habits and investment opportunities and offer new ways for people to invest and save.

But the benefits don’t stop with the consumer. Consumer-directed finance has the potential to benefit nearly every player in the industry, including small businesses, financial startups, fintechs, and arguably banks.

Consumer-Directed Finance Promotes Competition and Innovation

With new businesses entering the market, we’ll also see increased competition in the financial services industry, creating new opportunities for fintechs, neobanks, and other tech-savvy financial service providers. With more businesses offering innovative new financial services and products, that increased competition would also likely mean reduced costs for Canadians. Increased competition, reduced costs of financial products and services, and easier access to those services thorough apps are just some of the key benefits.

So, what about banks and financial institutions? Aren’t they at an increased risk of losing their customers? That’s the wrong question. For the banks that know the market better than anyone else, consumer-directed finance puts them at an increased opportunity of gaining new customers. It’s about perspective.

For many banks, consumer-directed finance provides them with new ways to improve personal banking experience. Banks focused on innovative solutions will have the ability to quickly respond to market demands and partner with new vendors to create better banking experiences. This system promotes technological innovation in banking, allowing financial institutions with enterprise software solutions to reach out to new technology partners and developers to create their own innovative solutions, and it allows them to launch new products and services faster than ever before. Banks are not just tied to one banking system and one vendor. They have new opportunities to improve the personal banking experience for their customers, gain new partnerships, and explore new product and service offerings.

When Is Consumer-Directed Finance Coming to Canada?

According to the latest report from the Open Banking Advisory Committee, along with pressure from industry players looking to capitalize on the opportunity and mitigate security risk of all Canadians, consumer-directed finance is on the horizon for Canada. The advisory committee has even encouraged the federal government to announce “a bold, clear and concrete timeline for delivering consumer-directed finance.”

It’s coming, but there’s still no indication of when exactly it’ll be rolled out. The next phase of the federal initiative has already been announced as the advisory committee shifts its focus to data security in financial services. With open banking initiatives and API-based pilot projects already underway in several economies around the world, including the UK, Europe, Australia, Japan, and New Zealand, Canada will have other international frameworks to look to as it builds out a consumer-directed finance platform that’s stable, secure, and is focused on improving banking for everyday Canadians.

https://www.canada.ca/en/department-finance/programs/consultations/2019/open-banking.html

Comments are closed.